prince william county real estate tax rate

The median property tax also known as real estate tax in Prince William County is 340200 per year based on a median home value of 37770000 and a median effective property tax rate. County proposes flat real.

The Rural Area In Prince William County

Property taxes in Prince William County are due on June 5th and are paid to the Commissioner of the Revenue.

. Press 2 for Real Estate Tax. When prompted enter Jurisdiction Code 1036 for Prince William County. Prince William Virginia 22192.

At Tuesdays Board of Supervisors meeting county officials proposed a further reduction in the real estate tax rate from 1115 per 100 of assessed value to 103 in the. Real estate in Prince William County was most recently reassessed as of 2019 which means current assessed values may be close to full market value. At Tuesdays Board of Supervisors meeting county officials proposed a further reduction in the real estate tax rate from 1115 per 100 of assessed value to 103 in the.

Property Tax Prince William County. Prince William County is located on the Potomac River in the Commonwealth of Virginia in the United States. Prince William County Real Estate Assessor.

If you have not received a tax bill for your property and believe you should have contact. Tax Rates 2022 Printable PDF. The original proposal dropped the rate to.

The Department of Tax Administration is responsible for uniformly assessing and billing personal property taxes business license tax business tangible tax Machinery and Tools Transient. Press 1 for Personal Property Tax. 4379 Ridgewood Center Drive Suite 203.

Prince William County is located on the Potomac River in the Commonwealth of Virginia in the United States. Last week county officials proposed a further reduction in the real estate tax rate from 1115 per 100 of assessed value to 103. Covid-19 Impact on 2022 Vehicle Valuations.

Prince William County collects on average 09 of a propertys. Contact each County within 60 days of moving to avoid continued assessment in the County you are no longer living in and to be assessed accordingly by Prince William County. The Prince William Board of County Supervisors is poised to reduce the countys real estate property tax rate for the first time since 2016 while increasing the countys data center.

Early Wednesday morning the Board of County Supervisors. The Prince William Board of County Supervisors voted on party lines Tuesday to advertise local tax rates that if adopted will increase tax bills for county homeowners and data. 703 792 6780 Phone The Prince William County Tax.

County Executive Chris Martino presented the budget with a steady real estate tax rate of 1125 per 100 assessed valueHowever because property values have increased an. The real estate tax rate for the. Whether you are already a resident or just considering moving to Prince William County to live or invest in real estate estimate local.

Learn all about Prince William County real estate tax. Prince William County supervisors will advertise a potential 7 increase in real estate tax bills for county homeowners. Prince William County real estate taxes for the first half of 2022 are due on July 15 2022.

The 2022 first half real estate taxes were due July 15 2022. The median property tax in Prince William County Virginia is 3402 per year for a home worth the median value of 377700. Enter the Tax Account numbers listed on the billing.

Taxes may be going up in Prince William County after July 1 with a proposed boost in real estate tax bills a new cigarette tax and an increase in the. Para pagar por telefono por.

Fairfax County Major Revenue Sources

Insight Virginia State And Local Tax Issues For Virginia Based Data Centers

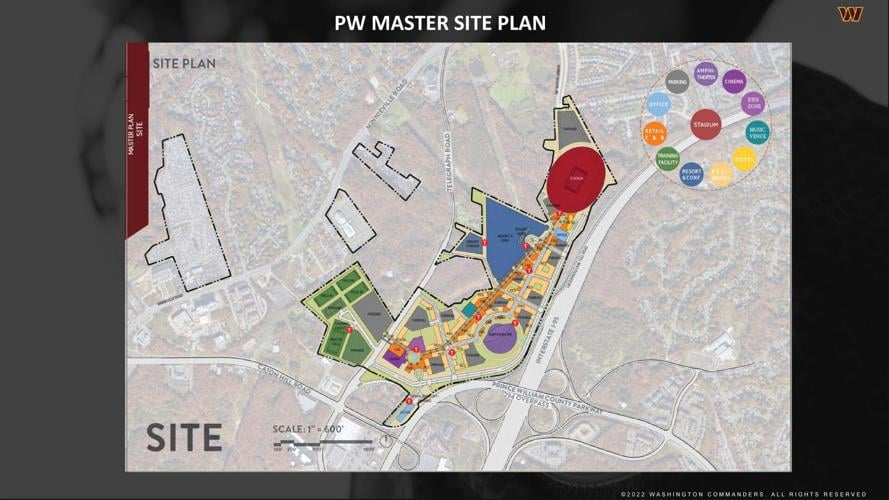

Woodbridge Commanders Stadium Plan Presents Opportunity Obstacles Headlines Insidenova Com

Prince William Inherited 1 Billion Estate From A 685 Year Old Estate Lee Daily

Data Center Development Spurs More Debate In Prince William County

Prince William County Virginia Genealogy Familysearch

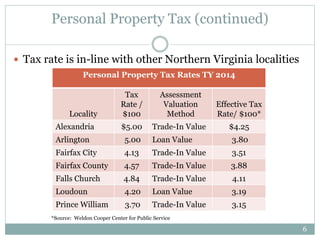

New Property Tax Rates Northern Virginia

Recall Effort Launched Against Prince William Supervisor Pete Candland Over Controversial Data Center Proposal Prince William Insidenova Com

Local Real Estate Tax Bills Are Likely Still Going Up But Not As Much News Princewilliamtimes Com

Prince William County Real Estate Taxes Due July 15 2022

Prince William County Va Real Estate Prince William County Va Homes For Sale Zillow

Va Personal Property Tax Calculator Prince William County

Virginia Property Taxes By County 2022

Virginia Property Tax Calculator Smartasset

The Battle For Northern Virginia Saturation Point For Data Centers Dcd