workers comp taxes for employers

EMPLOYERS Insurance - We Are Americas Trusted Workers Comp Insurance. When your employees are receiving workers compensation benefits they may wonder if theyll have to pay taxes on them.

Is Workers Comp Taxable Workers Comp Taxes

If an injured worker is receiving other types of disability or retirement benefits they may face other tax or financial.

. 4 Then the employee will be charged taxes on their workers compensation in an amount equal. The IRS manual reads. However each state specifies its own tax rates which we will.

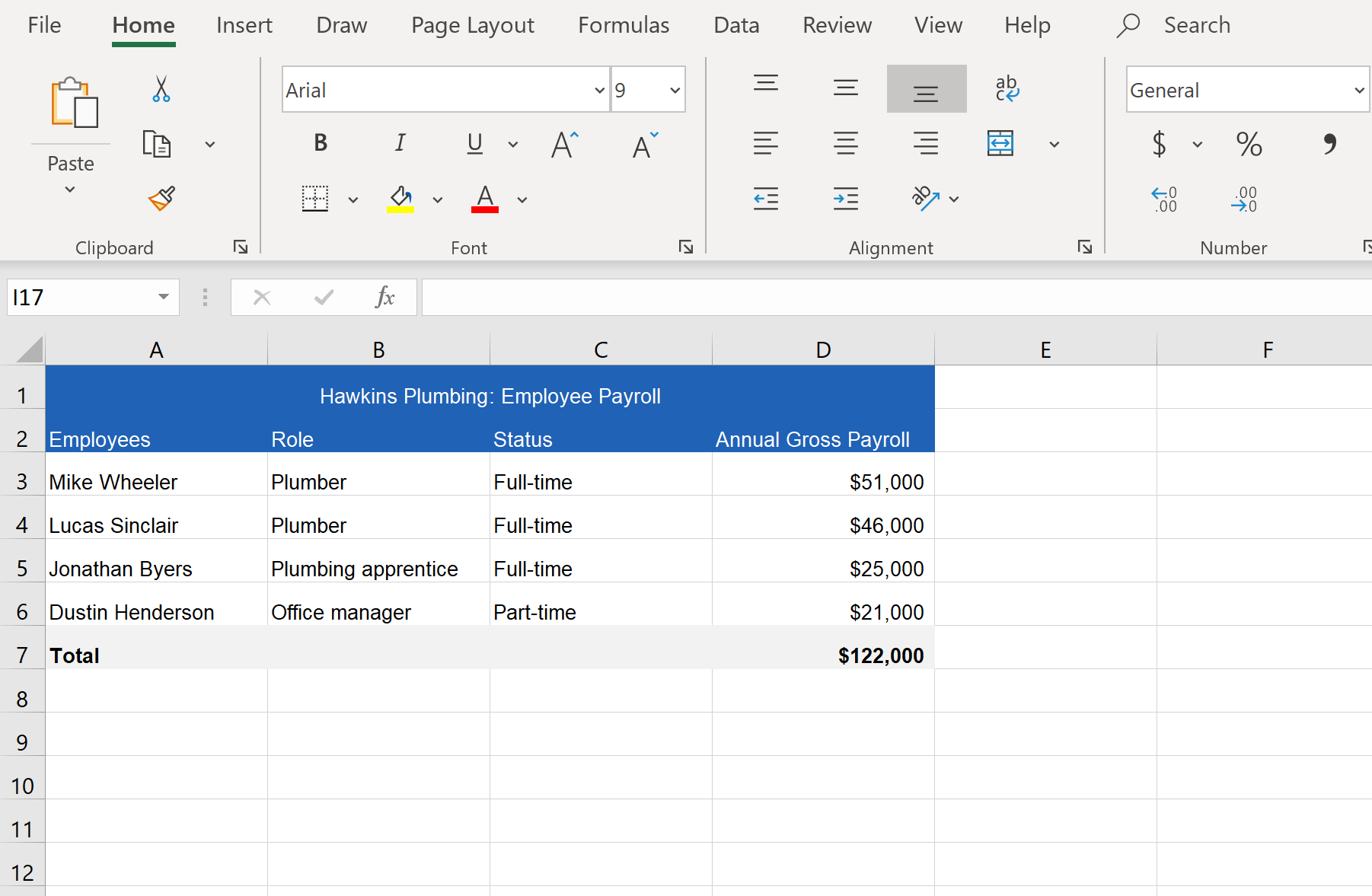

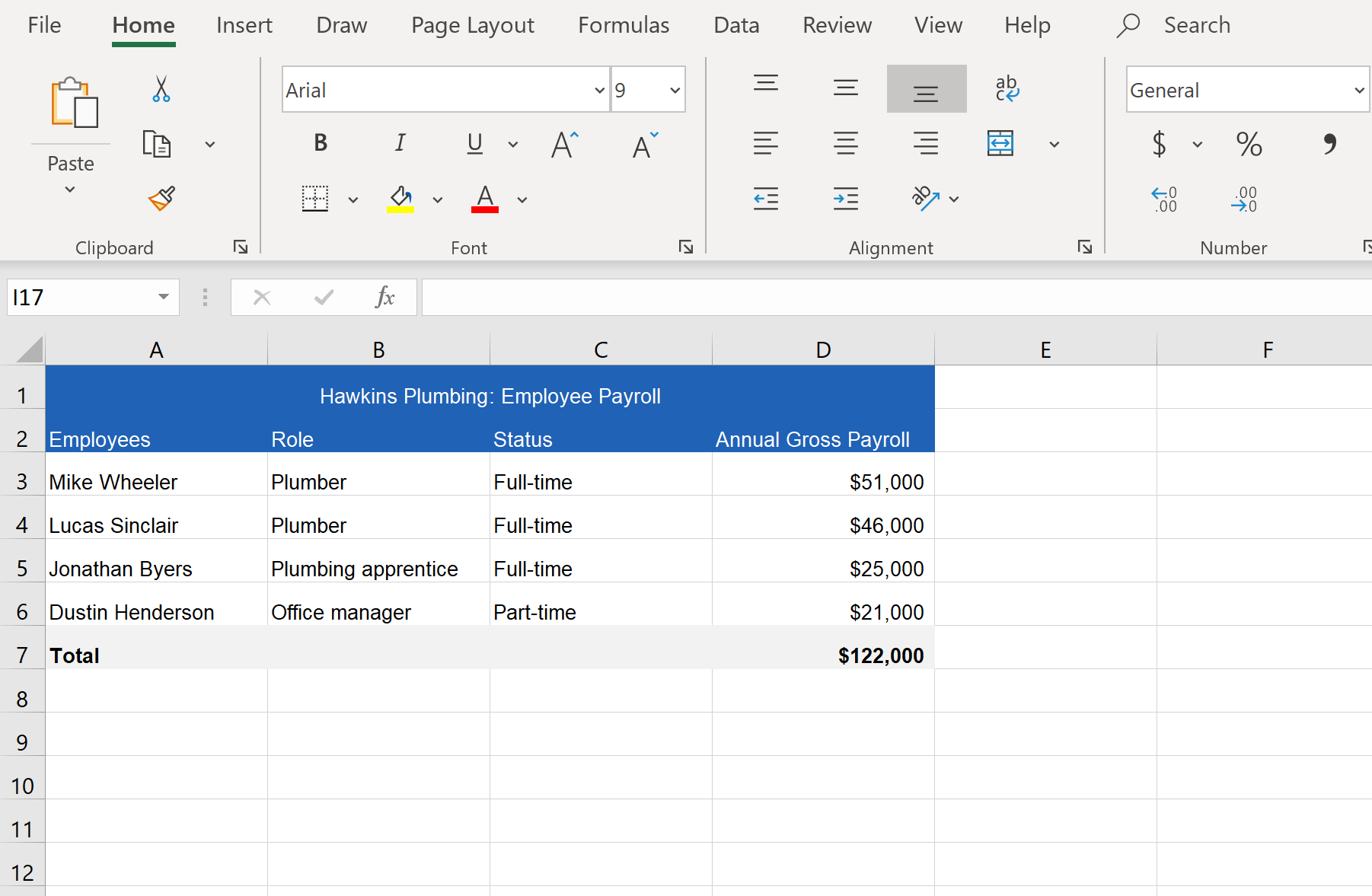

Employees receive a W-2 from their employer each year and the employer pays taxes and benefits on their behalf. Workers compensation is a public federally funded benefit that serves to protect injured workers while they recover. Workers compensation payouts are not taxed so the employer doesnt have to create a record for the IRS by issuing a 1099.

FUTA taxes fund state workforce agencies such as those that collect manage and enforce state unemployment taxes. Commuter and transportation benefits from businesses to their employees are typically excluded from being taxed. Since it is a tax-funded service it is free from tax that would otherwise feed its own money back into the system.

Workers compensation money is exempt from taxes in the overwhelming majority of cases. What to Know for 2022. Workers compensation is typically one of those legally required employee benefits.

However business owners can deduct their workers compensation taxes or payments to cover insurance premiums. Whether you pay Ohio BWC KEMI or popular private carriers like Travelers or Liberty Mutual one thing that is common across the board for work comp insurance is that your insurance premium looks more like a payroll tax then an insurance bill. Since having workers comp insurance is necessary for running a business business owners are able to deduct the costs of required insurance payments from their taxes.

Each employers premium is based on rates for different job categories that are multiplied by. Other payments to employees who are receiving workers compensation benefits such as a pension are taxable to the employee. Wages and salaries including retroactive pay compensation added to a paycheck if an employee was underpaid for some reason Overtime or double time pay at the employees base rate.

But there is an exception if youre also getting other disability benefits. Workers compensation benefits do have to be reported on a 1040 but are subtracted from an injured workers total income. Liability Requirements Exemptions.

The short answer is no workers comp payments are not reportable as income on a federal or state tax return. So if an employee at your small business is receiving more than 80 of their highest earnings category through their workers comp and SSDI benefits combined the SSA will reduce the SSDI payment so that the total amount will be 80 of their average current earnings. Missouri Employers involved in the construction industry are required to carry the coverage if they have one or more employees.

The simple answer is there is no such thing as a 1099 employee. So if a worker makes 10 an hour their base but they work overtime at 15 an hour you only owe workers comp on the 10 rate for those extra hours. While settlements in workers compensation cases are not generally taxable confidentiality provisions pushed by insurance companies and employers can place your settlement at risk of being taxed.

Both employers and employees are responsible for payroll taxes. Questions pertaining to Internal Revenue Service workers compensation issues may be directed to our Workers Compensation Center located in Richmond Virginia at 1-800-234-8323. You should ask the employer to issue a new 1099-MISC to cancel out the error.

Workers compensation for an occupational sickness or injury if paid under a workers compensation act or similar law. Workers compensation settlements and weekly payments are not subject to income taxes. This applies to all employers regardless of whether the employees are part.

In that sense workers comp is in the same. If you have any questions regarding the employees work requirements please contact employees manager at telephone. An individual worker is either a W-2 employee or they are a 1099 Independent Contractor.

Written by Ankin Law Office. It doesnt matter if your settlement is in a lump sum or structured to pay benefits over a period of time. Generally workers compensation benefits are not considered income and therefore are not subject to taxes.

Yes workers comp is taxable. It doesnt matter if theyre receiving benefits for a slip and fall accident muscle strain back injury tendinitis or carpal tunnel. If an employer sends you a 1099 for workers compensation payments they made a mistake.

The exception says that your workers comp payments may be taxable if youre also receiving Social Security Disability Insurance SSDI or Supplemental Security Income SSI. Since workers compensation benefits are not taxable the Internal Revenue Service does not allow taxpayers to deduct their awards. Employers are required to pay FUTA taxes on wages paid to employees that are not household or.

Your workers comp wage benefits are generally not subject to state or federal taxes. If you settle your claim for workers compensation and your employer asks you to keep the matter confidential you could face tax consequences. This should not be confused with other benefits you may receive such as unemployment benefits which are fully taxable or Social Security disability which may be taxable.

Missouri Employers are required to carry workers compensation insurance if they have five or more employees. Any workers comp payments and benefits that employers pay to their workers is a deductible business expense. The quick answer is that generally workers compensation benefits are not taxable.

The following payments are not taxable. Employers must also pay taxes under the Federal Unemployment Tax Act FUTA. The IRS Publication 525 states that amounts you receive as workers compensation for an occupational sickness or injury are fully exempt from tax if theyre paid under a workers compensation act or a statute in the nature of a workers compensation act This policy makes sense considering that any lost wages you receive from workers comp are already at a.

Federal tax rates like income tax Social Security 62 each for both employer and employee and Medicare 145 each plus an additional 09 withheld from the wages of an individual paid more than 200000 are set by the IRS.

What Is Workers Compensation Article

Workers Compensation Payroll Calculation How To Get It Right

What Wages Are Subject To Workers Comp Hourly Inc

What Is Workers Compensation Article

Types Of Injuries And Workplace Illnesses That Qualify For Workers Comp Safetyculture Blog Safetyculture Blog

5 Requirements For Workers Compensation Eligibility

Costratesadvisor Com Payroll Analysis Report Workers Comp Insurance Analysis Payroll Taxes

How To Calculate Workers Compensation Cost Per Employee Pie Insurance

How Much Does An Employee Cost Infographic Patriot Software Entrepreneur Business Plan Accounting Education Budget Help

If You Re Employed In Someone S House You May Think You Re Not Eligible For Workers Compensation Benefits Your Employer Doesn T Run Worker Helpful Thoughts

Workers Compensation Insurance Overview Amtrust Financial

What Wages Are Subject To Workers Comp Hourly Inc

Does Your Employer S Worker Comp Policy Pay For Lost Wages

Workers Compensation Insurance Overview Amtrust Financial

The 13 Benefits Of Workers Comp Insurance

Workers Compensation Attorneys In York Pa Free Confidential Consultation

Workers Compensation Insurance Overview Amtrust Financial